how are rsus taxed in california

This doesnt include state income Social Security or Medicare tax withholding. Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250.

Two Thirds Of Americans Aren T Putting Money In Their 401 K American Money Finance

Moves to California 100 shares vest this month.

. Most companies will withhold federal income taxes at a flat rate of 22. Not a resident of California granted equity of 6000 shares vesting monthly over 5 years ie 100 share per month for 5 years - January 2020. Theyre taxed as ordinary income - so its based on your marginal tax bracket.

There are two main formulas that the courts in California developed to determine how RSUs are divided in divorce the Hug formula and the Nelson formula. However its still important to understand and manage it appropriately. A percentage of the shares are withheld by the company for income taxes.

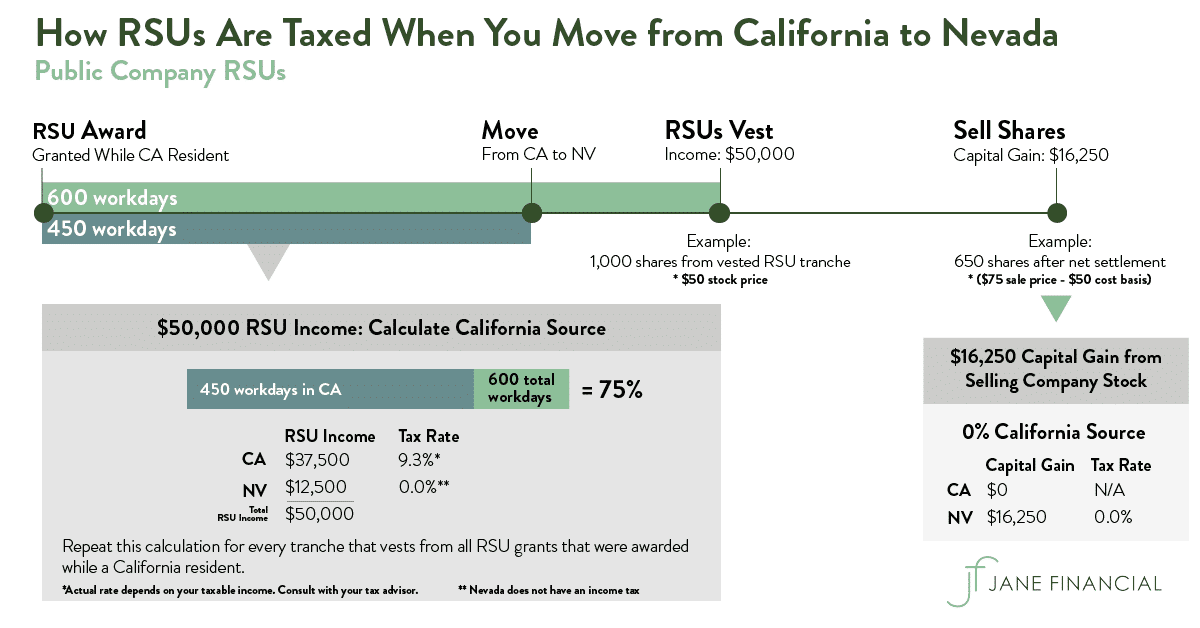

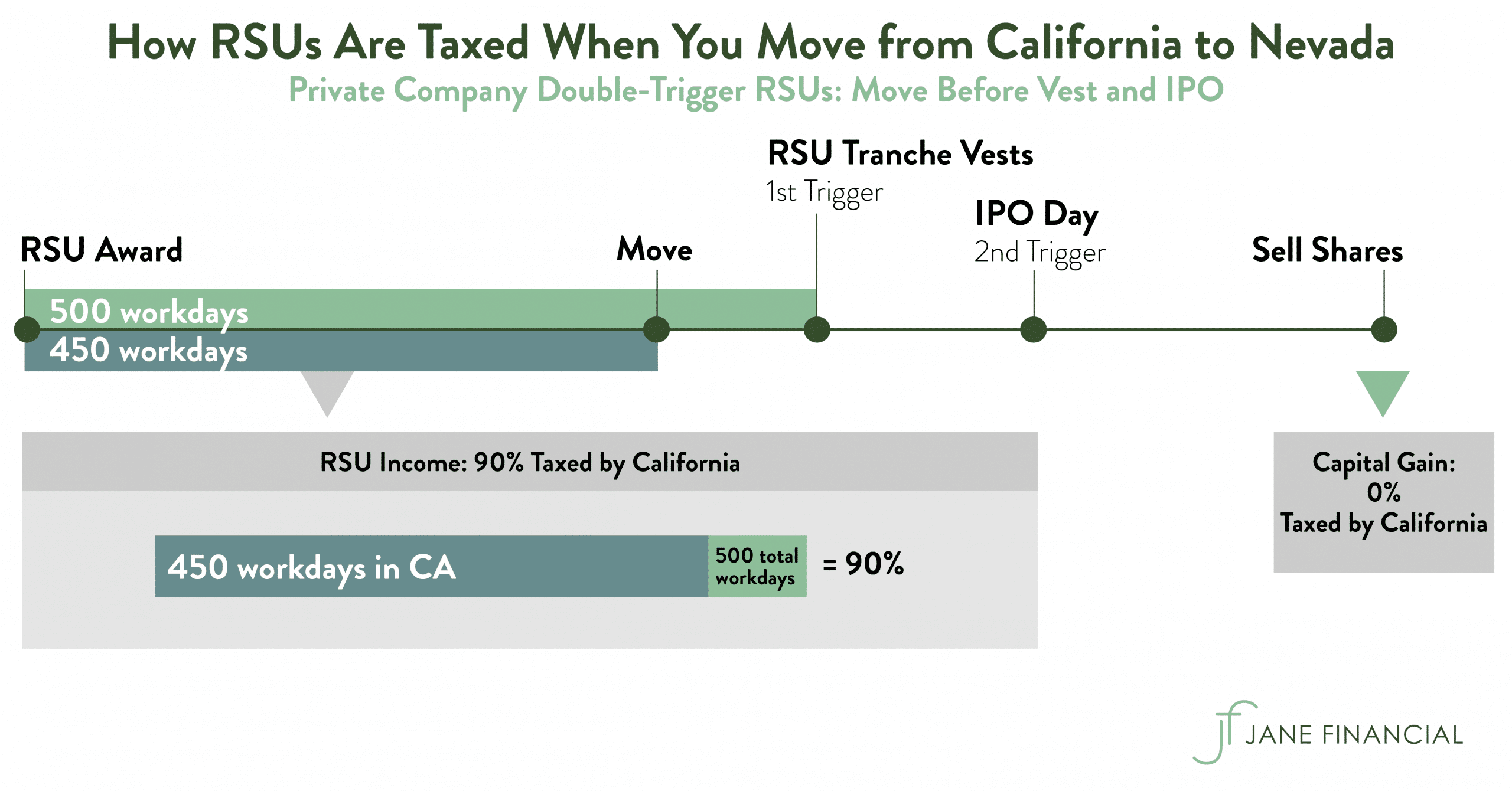

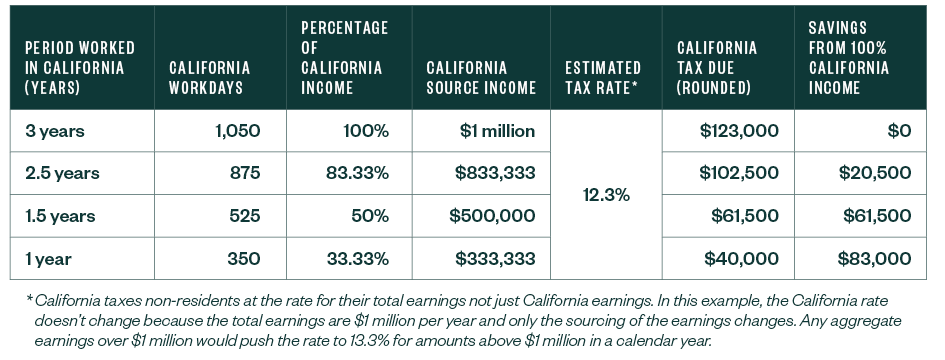

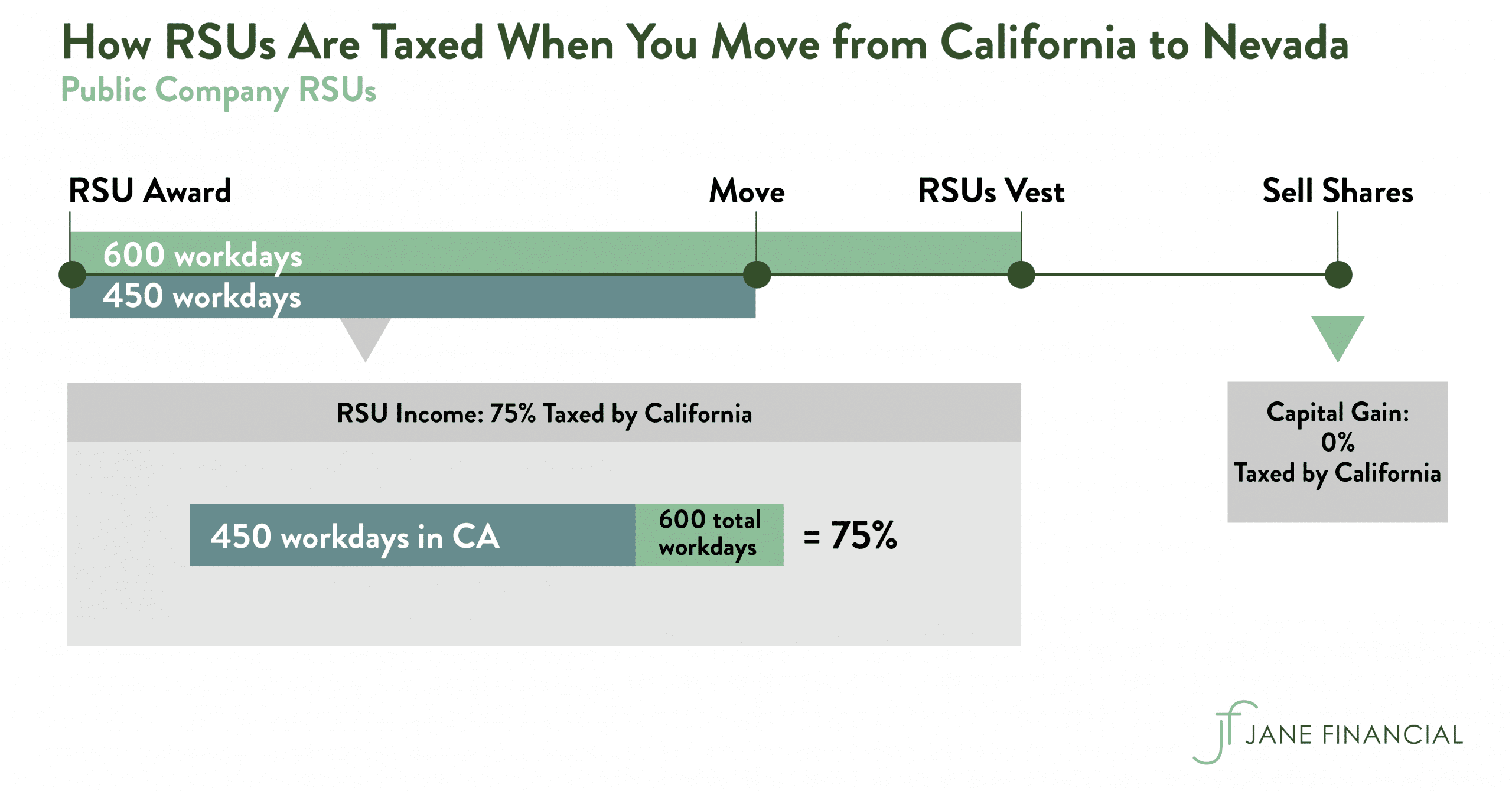

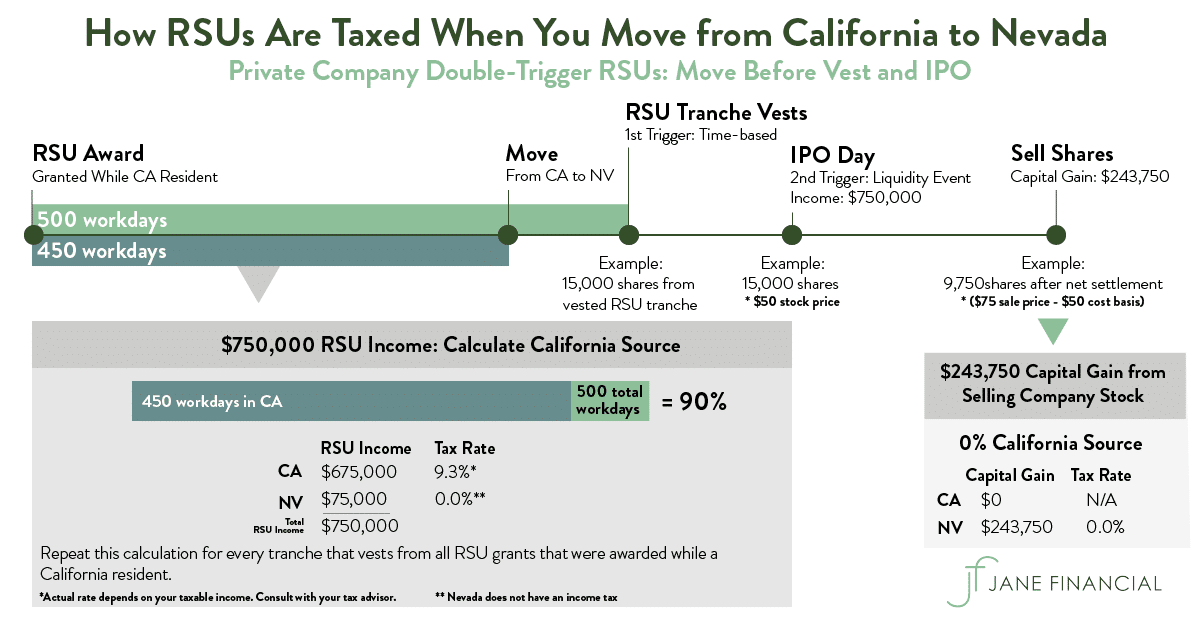

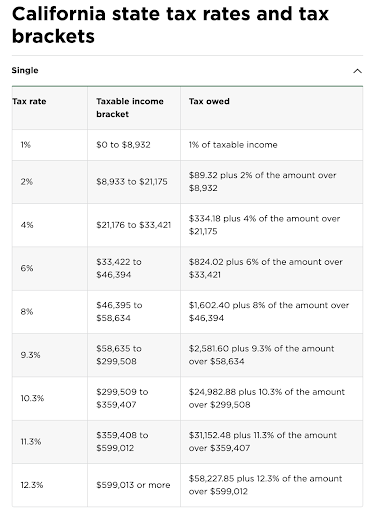

For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. Grant date when the RSUs were. For people working in California the total tax withholding on your RSUs are actually around 40.

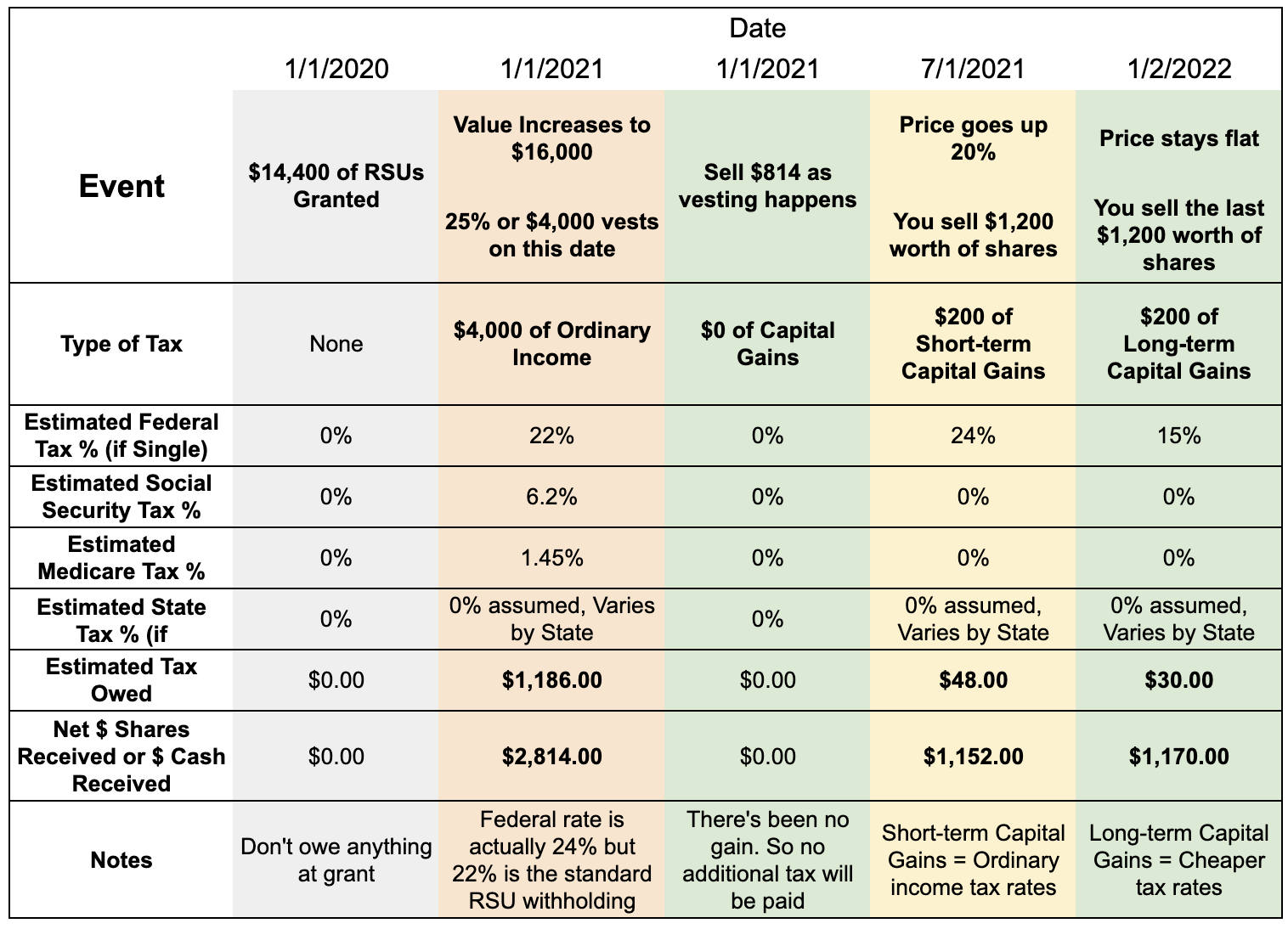

If you then hold the vested shares for over one year before selling them then any additional gains would be then be taxed at the long-term capital gains rate. With RSUs you are taxed when the shares vest not when theyre granted. RSUs are taxed as income to you when they vest.

Lets start with how taxes on Restricted Stock Units typically work. At vesting date California taxes the portion of the income from RSUs that corresponds to the amount of time you lived in. Your taxable income is 1000.

Think of it this way. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Absolutely but its important to keep in mind.

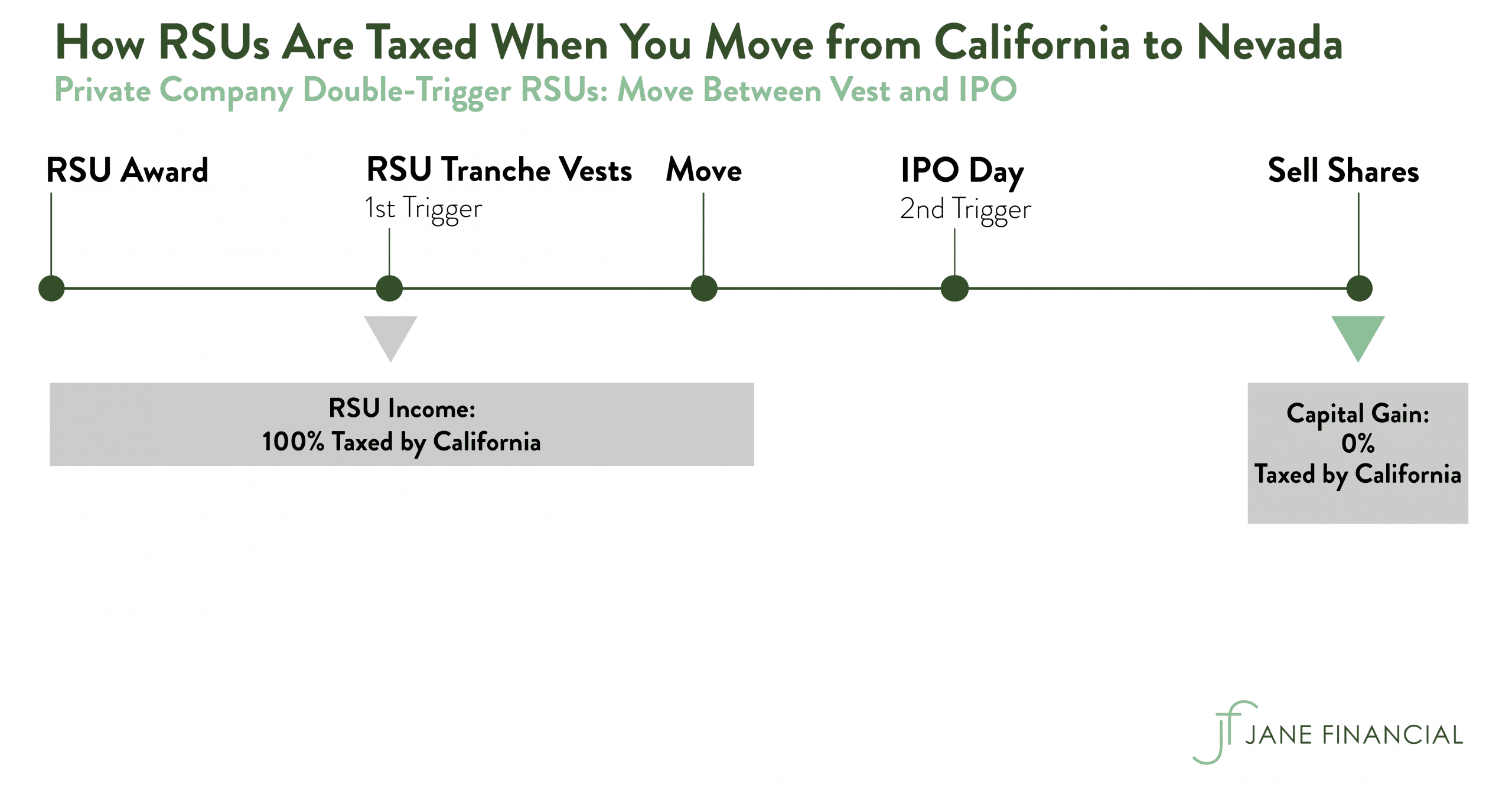

The employee receives the remaining after-tax shares. You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds several taxes using flat rates as defined by law eg 22 federal and 1023 California. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest.

Hire date when the employee spouse started work at the company GD. RSUs generate taxes at a couple of different milestones. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million.

The value of the rsus at the time of vesting is taxed as income. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. Before going into detail about these two formulas lets define some terminology.

Theyre taxed as ordinary income - so its based on your marginal tax bracket. If you dont sell for a year plus a day it is only additional gains which are taxed as long term gains - you still have a tax liability in the year of the vesting for the initial value regardless of whether you sold. RSU Wage Income of shares vesting x share price on date of vest This is standard for the IRS but what about from a state perspective.

In other words if the stock increase in value after youve paid ordinary income tax. Those plans generally have tax. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule. This compensation income is subject to federal taxes state taxes and payroll taxes Social Security Medicare. Once when you take ownership of the shares usually when they vest and again in another way when you actually sell the shares.

The value of over 1 million will be taxed at 37. RSUs are treated as supplemental income. There is no single rule or formula.

RSUs and Taxes. The IRS and California FTB measures your RSU income as each tranche vests. I have a question on how RSUs vest for non-residents who become temporary residents of California.

100 shares vest at 10share. The taxable income incurred on each vest is calculated as follows. I want to hear your stories.

100 shares vest. RSUs are generally taxable like salary when shares vest. How are RSUs Taxed.

The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares. Your taxable income is based on the value of the shares at vesting. Your taxable income is the market value of the shares at vesting.

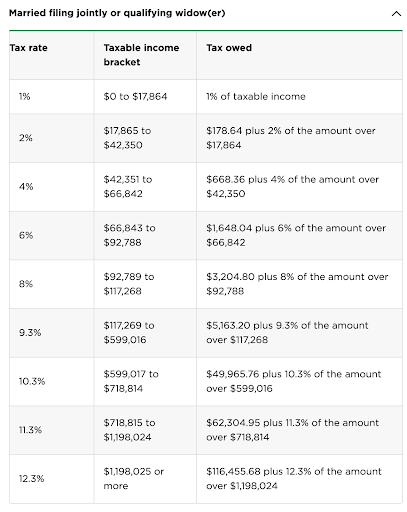

The 22 doesnt include state income Social Security and Medicare tax withholding. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Californias Office of Tax Appeals issued a non-precedential decision on the states taxation of restricted stock units RSUs affirming the Franchise Tax Boards grant-to-vest allocation method.

Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward. California law is vague when it comes to dividing RSUs in a divorce. Has anyone here with an RSU grant left California and become a resident of a state with no income tax and your company had an office in that state.

Again the income from RSU is taxable in the state of California to the extent that you worked there from the grant date to the vest date BUT the taxes arent owned until the shares are released so you could be paying taxes to California for years after you leave. Nov 18 2020 17 Comments. As the RSUs vest the value is taxed as income.

At any rate RSUs are seen as supplemental income. Because tax laws differ across states it all depends. In all states RSUs are taxed as regular income based on value at time of vesting.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. If so has the California FTB come after you. In fact courts are allowed to craft a different solution for each different situation.

If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future. In some states such as California the total tax withholding on your RSU is around 40.

How much will my RSUs be taxed. Taxes at RSU Vesting When You Take Ownership of Stock Grants. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. How are RSUs taxed in the state of California.

The World S 100 Trillion Question Why Is Inflation So Low Trillion The 100 Big Picture

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

How State Residency Affects Deferred Compensation

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

When Do I Owe Taxes On Rsus Equity Ftw

Thm Tuesday Tip New Accessories Freshen Up Your Home Interiors With Simple Home Improvements Before The Diy Home Improvement Home Improvement Throw Pillows